Can You Increase Your Credit Score

Let me tell you a story. This is one of those “don’t mess with the government” stories. Years ago when I first started working and filing taxes I had an, shall we say, incident. It was an early career type mistake. I’d made around $10,000 one year and was filing my taxes. Federal was easy, I was going to receive a refund. When I figured out my state taxes the end result was the state was going to owe me $1. Yes, one whole dollar. So I decided I didn’t need to file. Big mistake. This mishap soon had me asking can you increase your credit score.

5 years down the road I received a letter in the mail stating I owed the state over $2,000 in late fee’s and penalties. It took me over 5 YEARS to finally get it all worked out and off my credit history. Even more fun was the state had put a lien on a car I owned. This of course made my credit score take a nose dive for years. It was during this time that I asked many of my friends, can you increase your credit score? I was desperate to get it fixed! Lesson learned, don’t mess with the government. Even if they OWE YOU.

What is Your Credit Score

Let’s start with what exactly is your credit score. According to investopedia “A credit score is a statistical number that evaluates a consumer’s creditworthiness and is based on your credit history. Lenders use credit scores to evaluate the probability that an individual will repay his or her debts. A person’s credit score ranges from 300 to 850, and the higher the score, the more financially trustworthy a person is considered to be.”

Interestingly the credit score was invented by the Fair Isaac Corporation, or FICO for short. It is a score that is used by financial institutions to determine if you get extended credit. There are other credit scoring systems but the FICO is easily the most well known and used.

The way you build a high credit score and become less of a risk to a financial lending institution is to build a nice long credit history. You do this by paying your bills when they are due over a long period of time. The other key component is keeping your debt fairly low.

What Are Credit Score Ranges

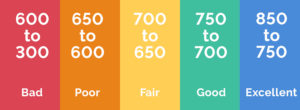

In general here are the widely accepted credit ranges.

Excellent: 750 and above

Fair: 650 – 699

Poor: 550 – 649

Bad: 550 and below

Something to remember is many lenders have their own ranges. For instance one lender might think that 720 and up is excellent while another believes that its 740 and above. They can all vary from lender to lender to some extent.

Credit Score Factors

When you find yourself wondering can you increase your credit score it’s important to keep in mind credit score factors. Here are the five major ones:

- Your payment history

- The total amount owed

- Types of credit

- Length of credit history

- New credit

Your payment history accounts for a whopping 35% of this total score. This is why it’s so important to pay your bills on time. The total amount or credit owed accounts for another 30% of the total. Good fuel for not overextending yourself with a huge mortgage, car payment, or credit card bills. Your history, or length of time you’ve had or used credit accounts for 15%. The more data they have of you paying your bills on time the better. Type of credit and new credit each account for 10% of the total. Type of credit is a mix of house, car, credit cards, students loans, etc. New credit is the number of accounts you have recently opened.

How Your Credit Score Goes Down

Here are the most common reasons you will see a drop in your credit score. Seeing a few of these will have you asking how can you increase your credit score:

Your credit utilization increased – This refers to how much available credit you have at any given time. So if you have a credit card with a $10,000 limit and you don’t owe anything, that’s great. The following month you charge $5,000 on it and haven’t paid it yet, your utilization just went up.

Your credit utilization increased – This refers to how much available credit you have at any given time. So if you have a credit card with a $10,000 limit and you don’t owe anything, that’s great. The following month you charge $5,000 on it and haven’t paid it yet, your utilization just went up.

You miss a credit payment – This is worth knowing very well. Missing payments on your mortgage, car, credit cards and student loans is bad. Quite bad in fact. This will cause your credit score to take a sizable blow.

Derogatory mark was added – When something like a lien (like I had), a mortgage foreclosure, bankruptcy or civil judgments can make your credit score drop. As you might have imagined.

You close a credit account – You would think that by closing a credit account it would help raise your credit score. The reverse is true.

You applied for a new loan or credit – Each time you apply for a new loan or line of credit your credit score gets pulled. Every time this happens your credit score goes down a little. No biggie if it’s one loan. String together 3-4 and it could cause an issue.

How You Can Increase Your Credit Score

Here are the best ways to address how you can increase your credit score:

Pay your bills on time – paying your bills on time is the number one way to increase your credit score. 6 months of on time payments are needed to start seeing a noticeable increase in your credit score.

Increase your credit line – If your credit cards are close to paid off sometimes it’s a good idea to call to increase your line of credit.

Don’t close credit card accounts – You will increase your credit if you cut up your credit card and never use it instead of canceling it. Weird but true.

Keep credit card balances low – When you have a lot of available credit but little that you actually owe this will help increase your credit score.

Leave previous debt on your credit report – Even though you paid off that car loan 10 years ago you want it to stay on your credit report. Some people look at their 25 years of credit history and think something that’s on there from way back should come off. Don’t do that, keep it all there.

Watch for errors – Every 12 months you can get a credit report from one of the three major credit bureau’s. These are Equifax, Experian, and TransUnion. 5% of people have an error on their credit report. Get it fixed.

Keep debt low on credit cards – Ideally you want to keep your debt utilization under 30%. So if you have a credit card with a $10,000 limit do your best to keep the amount you owe under $3,000.

Resources

Now that we’ve answered the question can you increase your credit score here are some resources to assist in the effort.

How to Boost Your Credit Score 100 points in 30 Days Without Credit Repair! – by Brian Diaz

Credit Repair Kit: Do It Yourself Guide To Success – by Bell Financial Services LLC.

DIY Free Credit Repair & Restore – by Rob Freeman

Credit Boss: A Step By Step Plan To Repair Your Credit Like The Pros – by Bianca S. Jules

Conclusion

Alright gang, we’ve taken a good look at how credit scores as well as what hurts it and what helps it. Hopefully after reading this you know enough to answer the question can you increase your credit score. The short answer is yes, absolutely. Like a lot of things you can definitely make and impact, it just takes some work and discipline. It’s always a good idea to check your credit score from time to time. If you find a mistake, point it out.

Keeping an eye on your credit score is a good way to help navigate your financial well-being.

In good financial health,

Mat A.

with all the great technology people are still unaware or their credit scores!Honesty I didn’t think much of them when I turned 18, I just knew I could get a credit card.

Knowing how to use and manage your credit score can make life so much easier! Thank you for sharing this great information and I look forward to continually read more content from your website!

Thanks,

Timm

Hey Timm!

Thanks for the comment and stopping by. I agree, it seems like way too many people aren’t aware of their credit score. It’s so easy to get to as well!

Hi

Thanks for this well written post its very good to know these points.

Its absolutely crazy to think that closing down credit cards can have a negative effect on your credit score, you automatically think the less credit you have the better, but seems not. You learn something new everyday.

I also never knew you could have old data taken off your history if you wanted too.

Thanks for stopping by Dianne! I thought it was pretty weird that closing down a credit card would hurt your credit score as well. Always good to learn new things.